Lexin Reports Q3 Financial Results, Strengthening Focus on Scenario-Based and Ecosystem Businesses with Great Operational Resilience and Solid Operational Performance

Shenzhen, China, Nov. 25, 2025 (GLOBE NEWSWIRE) -- On November 24, Beijing time, LexinFintech (NASDAQ: LX), a leading Chinese new consumption digital technology service provider, announced its unaudited financial results for the third quarter of 2025. Facing multiple challenges from macroeconomic conditions and industry fluctuations, Lexin’s unique ecosystem business, built over years of experience, demonstrated operational resilience this quarter. Overall, Q3 results remained solid, with revenue of CNY 3.42 billion and Non-GAAP EBIT of CNY 675 million, representing a 1.5% quarter-on-quarter increase.These results reflect Lexin’s adherence to a long-term development philosophy, its user-centric approach, and the establishment of differentiated competitive advantages.

In terms of scale, the company reported a transaction volume of CNY 50.89 billion, a managed loan balance of CNY 101.84 billion, and 240 million users in the third quarter, representing a 7.7% year-on-year increase.

Regarding asset quality, the overall 90-day-plus NPL ratio decreased by 15 basis points quarter-on-quarter and 74 basis points year-on-year, continuing to demonstrate solid asset quality performance.

In terms of financial metrics, the company’s net profit take rate reached 2%, improving by 9 basis points quarter-over-quarter and 92 basis points year-on-year, achieving seven consecutive quarters of steady improvement.

While delivering stable operating results, the company has continued to prioritize shareholder returns. The first-half dividend was paid during the third quarter. For the second half of the year, the dividend payout ratio has been increased from 25% to 30% as previously announced. In addition, more than half of the US$60 million share repurchase and share accumulation plan disclosed earlier has already been executed.

Xiao Wenjie, LexinFintech’s CEO, stated: “With the implementation of the new regulations, the industry is set to move toward healthier and more orderly development. We will further expand our presence across consumer scenarios, deepen our services for micro and small businesses, and increase our investment in financial technology. Our unique multi-business ecosystem will increasingly demonstrate differentiated competitive strengths.We will also continue to enhance our user-centric operating framework, placing greater emphasis on user experience and consumer protection, ensuring that the company remains well-positioned for the future.”

Ecosystem Business Demonstrates Differentiated Competitive Advantages, Supports Micro and Small Enterprises, and Unlocks Consumption Potential

In the third quarter, the Company’s ecosystem businesses, including consumer instalment e-commerce, consumer finance, inclusive finance, digital technology business and overseas business, enhanced coordination among their operations. By integrating online and offline scenarios, these businesses helped stimulate consumption, support the development of micro and small enterprises and improve the availability of financial services. At the same time, ongoing improvements to the user experience have contributed to building a differentiated competitive edge and shaping a business ecosystem capable of serving users across multiple segments.

Lexin Empowers Consumer Spending Through Scenario-Driven Solutions

Boosting consumption remains a key policy priority, and as a bridge between financial institutions and the consumer market, Fenqile Mall focused in the third quarter on core consumption scenarios for young consumers while continuously optimizing its high-quality product supply chain. This drove a significant increase in transactions of daily consumer goods, with quarter-on-quarter growth of 58.5% and year-on-year growth of 133.8%, accelerating the release of rigid consumption demand.During the quarter, the platform upgraded its logistics and delivery system, reducing delivery times by more than 20 hours. In addition, quality inspection services were strengthened to minimize the risk of problematic products entering the consumer market, providing a more efficient and secure shopping experience. During the recent “Double Eleven” shopping festival, overall transaction volume on the platform increased by 38% year-on-year, while transactions of daily consumer goods surged 237% year-on-year.

In the area of personal consumer credit services, the Company worked with financial institutions during the quarter to optimize credit funding, upgrade products and services, and provide flexible financial solutions such as “on-demand borrowing and repayment” and “interest-first, principal-later”. These measures benefit a broader segment of potential consumers, channel consumer credit into high-quality scenarios, and inject healthy and sustainable momentum into the consumption market.

Fenqile Inclusive Finance Supporting the Growth of Small and Micro Enterprises

Fenqile Inclusive Finance focuses on serving micro and small enterprises in lower-tier markets. Currently, it operates in over 330 counties and cities across 30 provinces, municipalities and autonomous regions. In the third quarter, in alignment with the “Finance for the People” policy initiative, Fenqile addressed key pain points faced by micro and small enterprises, including limited access to financing, low matching efficiency, and cyclical funding needs, by upgrading its big data risk control system and modeling tools to improve the accuracy of microenterprise risk assessment.Adopting a localized operating strategy of “local staff serving local users,” Fenqile’s offline service personnel assist micro and small enterprises in organizing operational data, uncovering production scale, order flows and customer reputation, collectively capturing the enterprises’ intangible operational capabilities. This approach enables a better match between inclusive credit products and microenterprise financing needs. During the third quarter, Fenqile helped nearly 160,000 users obtain inclusive loans totaling approximately CNY 5 billion, channeling financial resources to broader lower tier cities and supporting small local businesses and skilled local entrepreneurs.

The Company continued to maintain positive momentum in digital technology and overseas business in the third quarter, achieving steady scale growth.

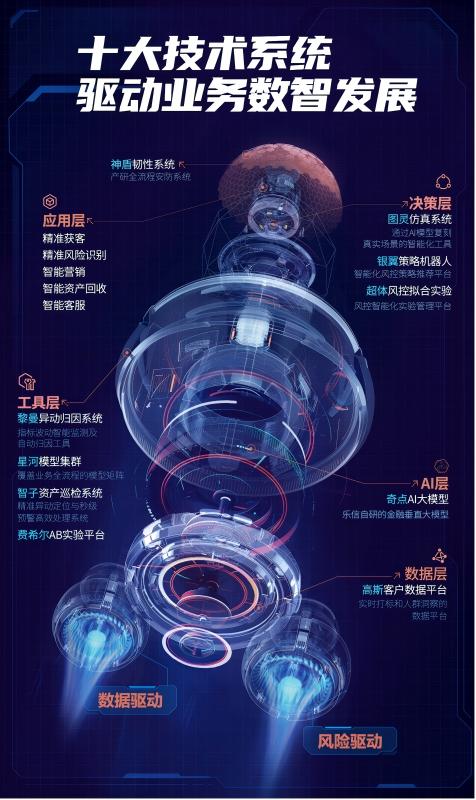

According to the financial report, the Company continued to increase technology investment year on year in the third quarter. It maintained leading investments in areas such as AI risk management and AI-powered customer service, while continuously upgrading its underlying capabilities. These initiatives enable the new quality productive forces to consistently generate competitive advantages.

In the third quarter, Lexin further advanced its AI strategy by developing its in-house large language model, LexinGPT, which now incorporates more multidimensional data. This has improved the accuracy of user demand recognition by over 20%, providing stronger decision-making capabilities for AI agents across various scenarios.With the enhanced capabilities of LexinGPT, an increasing number of “AI agent roles” have been deployed within the company. For instance, in the risk control domain, AI agents now construct comprehensive risk strategy maps and structurally identify redundancies and flaws in complex historical strategies. The end-to-end process from textual requirements to strategy generation is fully automated, achieving several times the efficiency of manual operations and strengthening the intelligence foundation for risk management and profit assurance.In high-frequency scenarios such as credit approval and repayment, customer service AI agents leverage their specialized capabilities to support continuous dialogues and knowledge expansion. This has reduced average response times to under 10 seconds and increased the rate of intelligent resolution of user queries to nearly 90 percent.

In the third quarter, the company developed an AI composite agent matrix, enhancing data and task collaboration among agents across different scenarios and taking business coordination efficiency to a new level. As composite agents are scaled across business scenarios, the company’s operational and management effectiveness is expected to continue improving, further solidifying its leading position in AI-enabled financial services.

The industry has now entered a new phase of high-quality competition, where the ability to protect consumer rights has become a core competitive advantage. Lexin remains committed to a user-centric service philosophy, upgrading its consumer protection system across governance, products, and services to strengthen safeguards for users. Leveraging technology such as online customer service and AI customer service agents, the company continuously improves service efficiency and quality, while establishing a user feedback-driven mechanism for product optimization to enhance user satisfaction from the source.

Leveraging its continuously strengthened comprehensive leadership in consumer services, consumer ecosystem development, and technology enablement, Lexin was recently listed among the “2025 Guangdong Top 500 Enterprises” & “the 2025 Guangdong Top 100 Private Enterprises”, the only fintech enterprise honored with both rankings in 2025.Thanks to its innovation and industry influence in AI technology applications, the company was also awarded the “Best AI Technology for Financial Technology Company in China” at The Asian Banker Awards 2025, making it the only fintech company to receive a technology award this year. This marks the seventh consecutive year that Lexin has been recognized by this internationally authoritative institution.

Chuanda Xu chuandaxu@lexin.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.